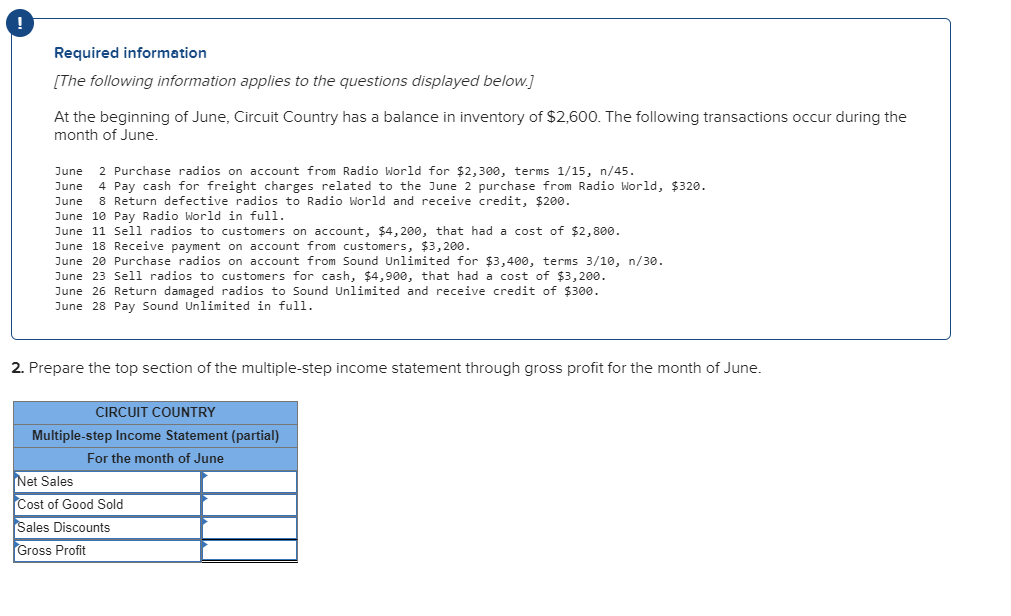

Can you score property equity credit line with an enthusiastic fha loan? Short respond to:

A property collateral credit line try an extra mortgage note predicated on equity of your property. Speaking of unavailable through the Government Property Government, you could obtain a HELOC if you have an enthusiastic.

FHA was an in person had webpages, is not a federal government company, and won’t generate loans. FHA try a yourself owned site, is not a national department, and does not create funds. Our home security financing gives you, since a homeowner, to borrow money while using the equity on your own house as the collateral.

A property equity personal line of credit are a moment financial note according to security of your property. Talking about unavailable through the Federal Homes Administration, but you can receive an excellent HELOC for those who have an FHA mortgage and construct adequate security in your house so you can meet the loans South Coventry requirements.

If you have too much security in your home, often as the you have paid down your financial otherwise because sector worth of your home has grown drastically over the harmony your owe to your property, you happen to be in a position to see a large loan.

Talking about not available from the Government Houses Management, but you can get a HELOC when you yourself have a keen FHA mortgage and build adequate equity in the home so you can be considered. An effective HELOC try a revolving line of credit having property owners so you can accessibility doing the credit range limitation as required.

How much cash family security financing do i need to score FHA?

You might borrow as much as 80% of the newest worth of your house. Such as for example, if for example the house is value $3 hundred,100, the most might be $240,000. Once you’ve paid down your current home loan, after that you can get the left currency because the a lump sum payment.

Could you getting refused property collateral credit line?

Their HELOC is protected from the collateral you have on the household, and in case you don’t need adequate equity, you will be refused. You will likely need no less than 20% collateral of your property one which just will be accepted getting an excellent loan of any number.

What sort of credit score do you wish to rating a beneficial HELOC?

Your credit rating is among the key factors lenders imagine when determining for many who be eligible for a property collateral loan or HELOC. A great FICO Score? with a minimum of 680 is usually needed to qualify for a great family collateral mortgage otherwise HELOC.

What exactly is FHA collateral funds?

The home collateral mortgage allows you, while the a citizen, to help you borrow money when using the collateral in your house since security. The lending company increases the complete number of to the mortgage to the new borrower, and is also paid off which have a fixed rate of interest more the term of the loan.

Do you pull out more funds with the an effective FHA financing?

Is Good HOMEBUYER Gain benefit from the Advantages of An FHA Home loan To your A beneficial «FIXER Higher?» Seriously. An application called HUD 203(k) allows certified people get fixer-uppers which have FHA secured funds, plus has built-into the cover to your debtor should the resolve and you can renovation processes cost more than questioned.

Just what disqualifies you from getting a property guarantee loan?

A loans-to-earnings ratio less than 50% Lenders will require you to definitely features a loans-to-earnings ratio of 43% so you’re able to 50% at most, however some requires so it as also all the way down.

Can it be simple to get approved to own a beneficial HELOC?

Appropriate credit score conditions will vary of the financial, however you basically you desire a get from the mid-to-high 600s in order to be eligible for a house security financing or HELOC. A leading get (imagine 760 or significantly more than) normally makes for the easiest certification techniques and offer your access on the lowest interest rates.